As policymakers weigh new rounds of tariffs on imported goods, business leaders are bracing for yet another hit to margins. From automobile makers to home goods retailers, many companies will soon face a familiar question: absorb the extra costs or pass them on?

For some brands, that decision isn’t as painful as it sounds.

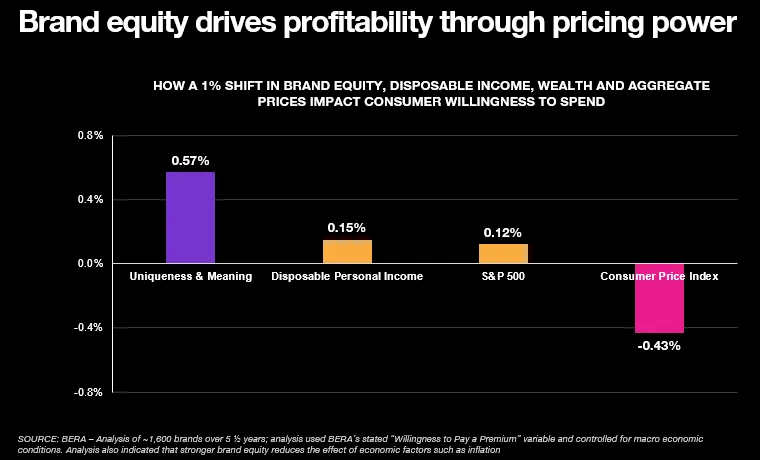

According to new research from BERA.ai, companies with strong perceptions of uniqueness and meaningfulness—two of the metrics that contribute to brand equity scores—are far better equipped to maintain pricing power when economic pressures mount. The implication: in periods of cost volatility, branding may be a company’s most effective defense.

Costs Are Rising. So Are Questions.

The mechanics of tariffs are straightforward. Additional duties imposed on imported goods increase the cost of production or procurement. Companies are then left with two immediate paths: raise prices or accept tighter margins.

For low-equity brands, neither option is appealing.

“Brands that lack differentiation often struggle to raise prices without losing customers,” says Ryan Barker, founder of BERA.ai. “But for brands with strong emotional connections and perceived value, the story changes entirely.”

BERA’s latest pricing power model—which analyzed 1,600 brands across 140 categories—found that a 1% increase in a brand’s uniqueness and meaningfulness scores led to a 0.57% lift in consumer willingness to pay. That lift, researchers note, is significantly greater than the impact of macroeconomic factors like disposable income or S&P 500 performance.

Sector by Sector, The Gap Widens

Brand resilience under pressure isn’t evenly distributed across industries.

BERA’s data shows that Interactive Media & Services brands saw the greatest pricing power increase (+0.85%), followed closely by Automobiles (+0.67%), Software (+0.68%), and Insurance (+0.67%). These are categories where differentiation and long-term loyalty tend to be stronger and where brand equity may help offset the worst of tariff-induced cost hikes. By contrast, categories like Beverages (+0.42%) and Restaurants & Hotels (+0.48%) experienced more limited pricing flexibility.

The practical takeaway? Companies with low equity will need to work harder—and likely spend more—to justify price increases in the months ahead.

A Case in Point: LEGO

The toy industry is no stranger to supply chain risk. In recent years, tariff-related costs and raw material volatility have tested even the most established players.

Yet through it all, LEGO has maintained a striking level of pricing stability.

While competitors have turned to promotions or SKU reductions to manage cost increases, LEGO has largely avoided discounting its core products. Analysts point to the brand’s consistently high scores on both uniqueness and meaningfulness, which fuel stronger perceptions of durability, educational value, and family connection.

During the 2019 U.S.-China trade tensions, LEGO’s pricing posture remained steady while other brands pulled back or adjusted packaging to offset costs. As BERA’s data indicates, that level of resilience is typical of high-equity brands that are perceived as both different and deeply relevant.

Leadership Under Pressure

For marketing and finance leaders, these findings may raise broader questions about resource allocation. In moments of economic pressure, brand budgets are often among the first to be scrutinized.

Some executives respond by reducing spend, delaying campaigns, or cutting agency partnerships. But data suggests that approach could be counterproductive.

“When brands go dark, they risk losing more than just visibility,” says Barker. “They lose the ability to justify their pricing and reinforce the value consumers perceive in them.”

Experts recommend that during periods of cost volatility, companies should:

- Focus on value and messaging clarity, rather than discounting.

- Prioritize brand attributes that consumers associate with innovation, quality, and authenticity.

- Maintain balance between upper-funnel brand investments and lower-funnel performance efforts.

A brand’s pricing power isn’t just about economics, it’s about perception,” Barker adds. “And perception is shaped by consistent, emotionally resonant communication.”

Gauging Your Own Pricing Power

For companies looking to evaluate their exposure to upcoming tariffs, the advice from BERA.ai is to start by assessing brand equity through three key questions:

- Is your brand perceived as unique and meaningful?

- Can it command loyalty beyond your immediate product category?

- Do you understand the emotional and functional attributes driving that equity?

In BERA’s model, brands that can answer “yes” to these questions are more likely to hold pricing power, protect margin, and retain customer loyalty during times of uncertainty.

What Comes Next?

As tariff decisions loom, the divide between high-equity and low-equity brands may only deepen. While product-level strategy will always matter, the evidence increasingly suggests that brand perception plays an outsized role in how companies weather financial stress.

Put simply: price elasticity is not just a function of what something costs. It’s a function of what something means.

And in uncertain times, meaning may be the most valuable asset a brand can have.