For decades, Walmart has been synonymous with low prices and budget-conscious shopping—a go-to destination for families looking to stretch their dollars. But a seismic shift is underway.

A growing number of high-income shoppers are filling Walmart’s aisles, signaling a transformation in how the retail giant is perceived. During Walmart’s Q3 2024 earnings call, CEO Doug McMillon revealed a striking data point: households earning more than $100,000 accounted for 75% of Walmart’s share gains in the quarter.

This shift isn’t just about inflation-weary consumers hunting for deals—it’s a sign that Walmart is successfully repositioning itself as a value-driven, convenient, and increasingly premium shopping destination. And the numbers back it up:

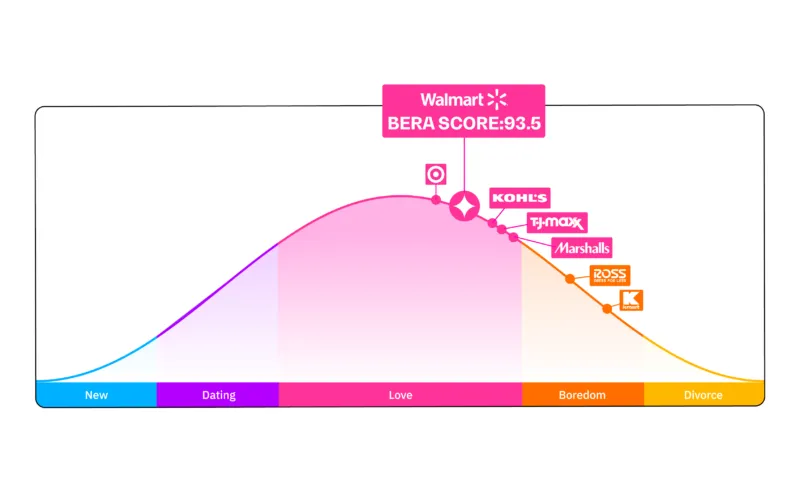

According to BERA’s real-time brand tracking, Walmart now ranks in the 93rd percentile for brand equity among $100k+ households, trailing just behind Target and surpassing competitors like Kohl’s, TJ Maxx, Marshalls, and Ross.

So, what’s fueling this momentum?

Why More High-Income Shoppers Choose Walmart

Walmart’s growing traction with affluent consumers isn’t a fluke—it’s the result of a strategic evolution in its brand positioning and offerings.

- Expanded E-Commerce & Digital Convenience: Walmart’s investment in fast delivery, curbside pickup, and a seamless online shopping experience has made it a go-to retailer for high-income shoppers who prioritize convenience.

- Premium Product Expansion: While groceries remain the primary draw for high-income shoppers, Walmart’s increasing assortment of high-margin categories—including premium beauty, fashion, and home goods—has made it more than just a discount destination.

- Store Experience & Perception Shift: Store redesigns and an improved shopping environment are redefining the Walmart experience, helping to shift brand perception from “budget retailer” to “smart shopping destination.

The result? More high-income consumers aren’t just shopping at Walmart—they’re returning.

Breaking Down Walmart’s Brand Strength and Challenges

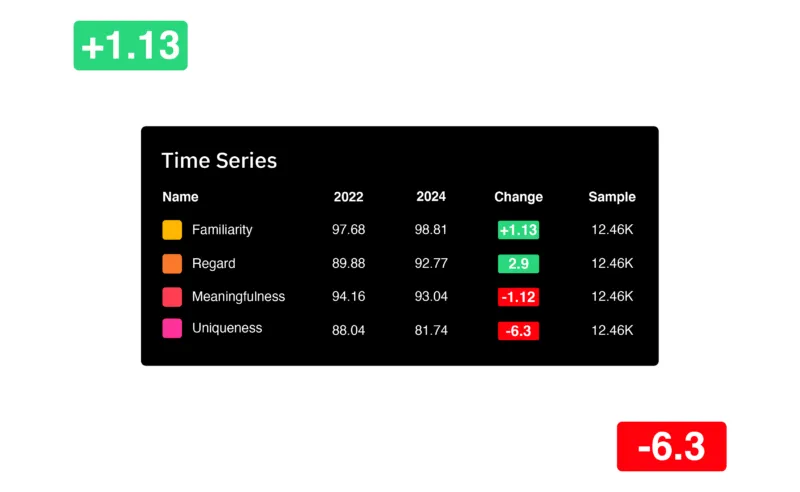

Walmart’s surge among wealthier shoppers is reflected in BERA’s brand equity tracking, which measures Familiarity, Regard, Meaningfulness, and Uniqueness—key indicators of brand health and emotional connection.

The retailer has high Familiarity, meaning shoppers recognize and acknowledge its presence in their buying routines. Regard is also strong, showing that Walmart is no longer just seen as a budget retailer; instead, it’s increasingly viewed as a smart shopping choice that blends affordability with reliability.

However, Meaningfulness and Uniqueness—which measures how deeply a brand is integrated into consumers’ lives and how well the brand is differentiated from competitors—have slightly declined. This suggests that while more high-income consumers are shopping at Walmart, they do not yet feel a strong emotional attachment to the brand.

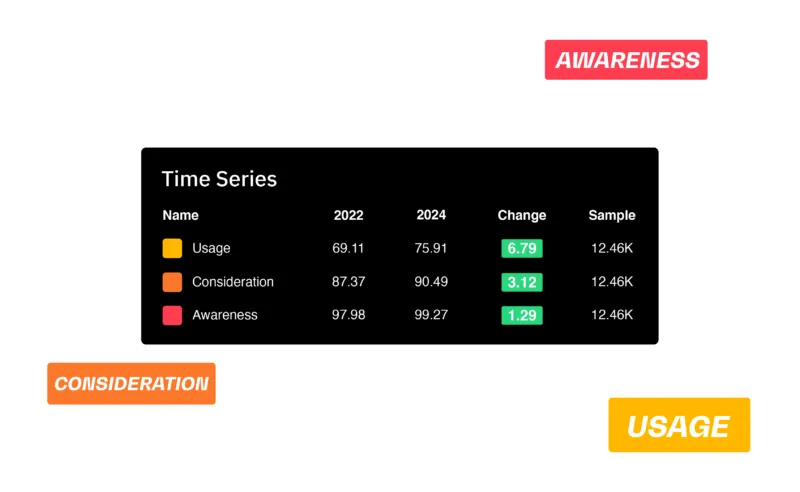

Walmart’s purchase funnel—spanning Awareness, Consideration, and Usage—is in strong shape. BERA.ai data shows that 75% of $100K+ households now shop at Walmart, proving that the retailer isn’t just drawing in high-income shoppers but converting them into loyal customers.

However, despite its success in attracting wealthier consumers, Walmart faces a challenge in maintaining pricing power and long-term retention.

The Pricing Challenge: Balancing Value & Retention

Even as Walmart attracts wealthier shoppers, inflation and shifting consumer behaviors have reduced category-wide pricing power. BERA.ai data shows that even affluent shoppers are prioritizing value over brand loyalty, making them more price-sensitive than before.

The challenge for Walmart? Sustaining its momentum while maintaining long-term retention and pricing power.

Final Takeaway: Economics, Perception, and Experience

Walmart’s rising appeal among high-income shoppers isn’t just a response to economic conditions—it’s the result of a deliberate and strategic shift in how the brand is positioned and experienced. By expanding its digital convenience, elevating its product offerings, and refining the in-store experience, Walmart has successfully bridged the gap between affordability and aspiration.

BERA.ai data confirms that Walmart is not just attracting but converting high-income shoppers, with 75% of $100K+ households now shopping at the retailer. However, the challenge ahead lies in deepening brand loyalty and maintaining pricing power, especially as inflation continues to drive value-conscious decision-making—even among affluent consumers.

For Walmart, the opportunity is clear: continue reinforcing its premium perception while staying true to the value-driven identity that has made it a retail powerhouse. If the company can cultivate a deeper emotional connection with this new wave of shoppers, it has the potential to reshape consumer expectations and redefine what it means to be a mass-market retailer in the premium era.

The bottom line? Walmart isn’t just gaining ground—it’s redefining what value means for the modern shopper.