Over the past few years, Tesla has implemented several major price reductions in a bid to increase market share by making electric vehicles more accessible to a broader market. But the results have been underwhelming. Despite lower prices, Tesla’s share of the U.S. electric vehicle (EV) market continues to shrink. The combination of reduced prices and falling market share is having a devastating effect on its bottom line. What’s going wrong?

The Data Doesn’t Lie: Tesla’s Brand Equity Has Dropped, Taking the Company’s Pricing Power With It

Tesla’s price cuts, which began in earnest in 2021 and continued into 2024, were initially seen as a move to lower barriers for consumers. For example, Tesla introduced the Standard Range RWD Model Y at $41,990 in 2021 and rolled out other models with significant price reductions in the following years, including cuts in April 2024 and September 2024. These efforts were geared toward enhancing Tesla’s competitiveness and making its electric vehicles more accessible.

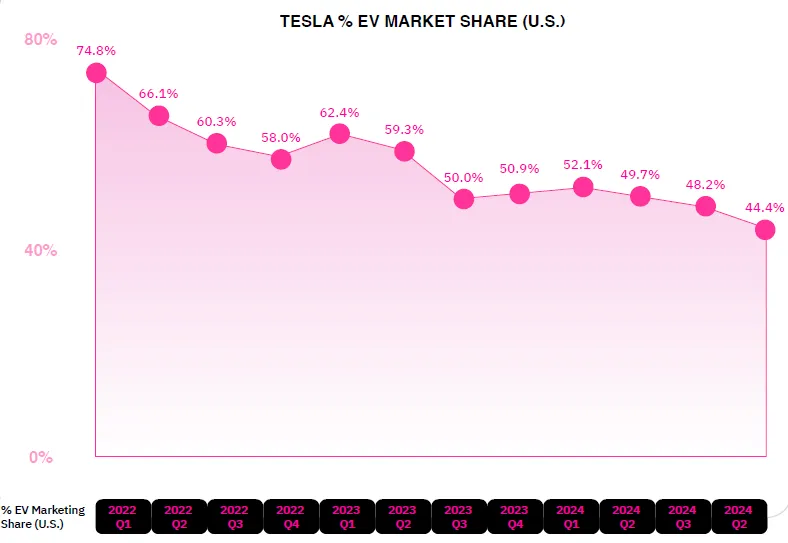

However, the effect on market share has been counterintuitive. Tesla’s share of the U.S. EV market, which was nearing 75% in early 2022, has dropped below 50% by the end of 2024.

This sharp decline in market share despite multiple aggressive price reductions has combined to produce a marked drop in Tesla gross margin–from 27.1% in 2022 to just 17.9% in 2024–illustrating the financial toll of price cuts with no offsetting benefit of market-share gains.

All this raises a key question: Why haven’t Tesla’s price cuts resulted in more market share? The simple answer is that Tesla is facing a significant erosion of brand equity, which has undermined its pricing power.

The Erosion of Tesla’s Pricing Power

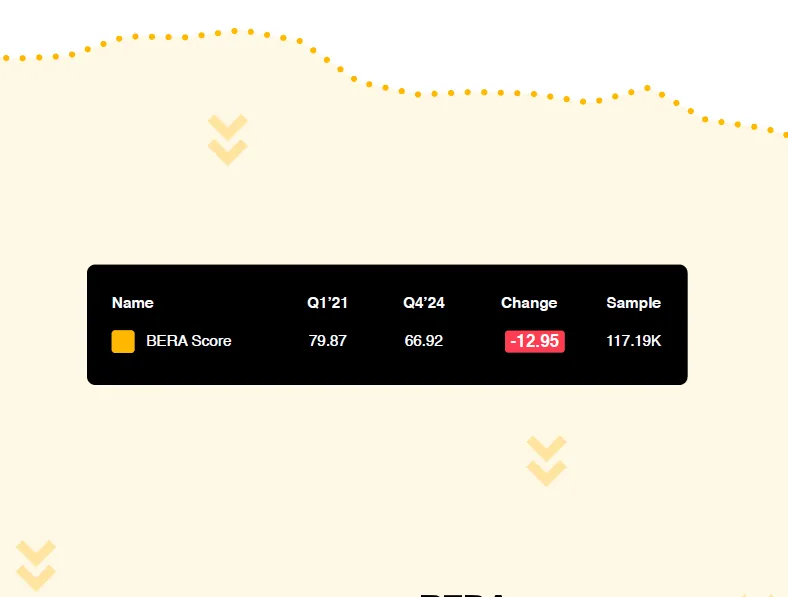

BERA.ai data underscores the critical impact of brand equity on consumers’ willingness to pay, which in turn, affects a company’s pricing power. Among the four key metrics that comprise brand equity—familiarity, regard, meaningfulness, and uniqueness—uniqueness and meaningfulness (the measures of how differentiated a brand is to a consumer and how integrated the brand is in the personal life of the consumer, respectively) have the largest impact on pricing power. A 10% increase in these two brand metrics could lead to a 6% lift in pricing power. In Tesla’s case, however, uniqueness and meaningfulness have sharply declined, resulting in a shrinking pool of consumers who are willing to pay a premium for Tesla’s EVs because of its brand.

Tesla’s Meaningfulness and Uniqueness Have Deteriorated

Tesla’s brand equity versus all brands dropped by 13 percentile points between 2021 and 2024, with the most significant decline beginning in mid-2022. The biggest contributor to this decline has been Tesla’s meaningfulness, which plummeted by more than 30 percentile points during this period. Meaningfulness is a crucial metric, as it reflects how relevant a brand is in people’s lives.

Interestingly, Tesla’s familiarity has increased during this period, meaning more consumers feel they know the brand, for better or worse. However, this has not translated into increased loyalty or willingness to pay because higher familiarity has been overwhelmed–tsunami-like–by Tesla’s loss of meaningfulness with so many consumers. Consumers are no longer as emotionally attached to the Tesla brand, and this emotional disconnection is driving a decline in its market share even with sharp price reductions.

Price Sensitivity and Its Link to Tesla’s Brand Erosion

As Tesla’s brand has become less meaningful and unique, its customers have become more price-sensitive, undermining its ability to command premium prices and hold share or alternatively, to gain share by reducing prices.

This shift is reflected in price elasticity, a metric that measures how sensitive consumers are to price changes. BERA’s data reveals that as Tesla’s brand equity has eroded, consumers’ price elasticity has increased; they are now more likely to prioritize price over brand loyalty. This increase in price sensitivity aligns closely with Tesla’s shrinking margins.

The drop in pricing power due to declining brand equity has created a vicious combination of both market share losses and margin erosion.

Revitalizing Tesla’s Brand Resonance to Restore Its Pricing Power

Revitalizing Tesla’s brand is key to addressing its current challenges. Price cuts alone cannot replace the deeper emotional connection consumers once had with Tesla. To take back its position as a leader in the EV market, Tesla needs to regain three brand metrics that made it meaningful and unique in the first place: how competent the brand is viewed among automobiles, the excitement it elicits in consumers, and how sophisticated the brand appears to consumers.